Alpha

At AxeHedge, we love bringing you curated content so that you can make informed investment decisions better and faster. Let us keep this one digestible for all you Alpha Hunters out there. This article sprints through what you need to know about Alpha (excess returns), how can it be calculated, together with a quick runaround of the investment community, and how can you find it. If you missed out Finance 101 in college, we’ve got you covered.

What Is Alpha in Simple Terms?

In finance, the term ‘Alpha’, denoted by the Greek alphabet ‘α’, which refers to the measurement of excess or abnormal returns on investment. Alternatively, this performance is typically benchmarked to a suitable market index, typically the S&P 500 or any indices of choice.

Excess returns, in this respect, are typically denoted by a whole number or percentage, in most cases, a baseline of ‘0’ is used as a reference to the benchmark. In this example, an alpha of 5 would imply that the returns of an investment have outperformed the benchmark by 5% within a specific timeframe. In instances where alpha is a negative value (i.e., -1), it would then indicate that the performance has underperformed by -1% relative to the benchmark.

Since the term ‘Alpha’ is typically used to benchmark returns to an index for investment funds, investors typically compare the performance of funds using alpha as a simple technique to determine the return on investment (ROI).

Alpha in Determining the Skill of a Manager

Whilst the Alpha is commonly used to measure fund performance together with excess returns, the definition of Alpha can be also utilised to identify a manager’s skill in managing the fund or investment. In another perspective, the skill of a manager also reflects the ability of her generating excess returns (vis a vis a benchmark) given the level of risk taken. Taking risk into account for investment allows us to peer beneath the veil to better understand how returns are generated by the manager. With a bit of mathematical work, alpha provides investors better clarity and context to a manager’s ability to generate performance.

Before we go further, consider the following formula:

Where:

The formula above simply explains how investors can calculate alpha, typically referred to as Jensen’s Alpha. This exercise allows us to better understand a fund manager’s performance against returns to that of another market-related investment (i.e., a fund managed by another manager), whilst considering a fund’s correlation to the market (denoted by Beta). In the case of Beta, a value greater than 1 (β>1) would indicate that an asset or fund brings greater levels of risk and implies greater gains (or losses) in times of large market swings or uncertainty.

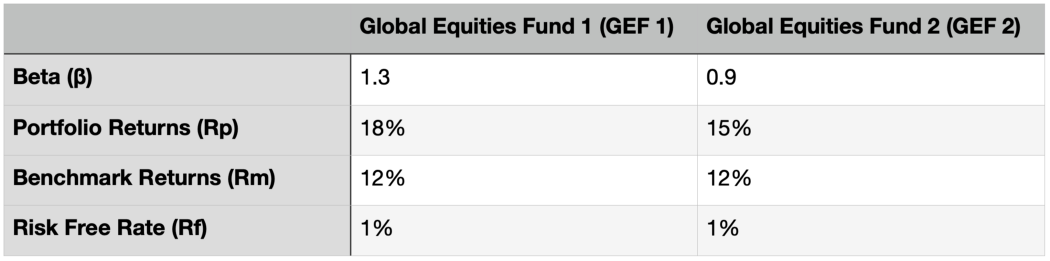

Now that we have a grasp of how alpha can be used to measure a manager’s ability to generate superior risk-adjusted returns, let’s see how this concept can be applied to the following example:

Note that:

- At first glance, an investor might be tempted to select GEF 1 as it generates superior returns, whereas GEF 2 might not be as attractive since it lags slightly behind GEF 1 in terms of performance; and,

- Notice that the Beta value (an indicator of risk) for GEF 2 is significantly lower than GEF 1, implying that GEF 2 is less susceptible to large fluctuations in times of market stress.

By calculating the value of alpha, we now have better clarity over which fund is more superior:

Based on the calculated results above, we conclude that despite the impressive returns reported by the first fund (GEF 1), it has a lower alpha value as opposed to the second fund (GEF 2). This also posits that the Manager of the latter fund is more adept at generating superior risk-adjusted returns when comparing the Alpha values for both of the funds.

To summarise, whilst the manager for GEF 1 is capable of generating greater excess returns, it achieves this at the expense of excessive risk-taking. By comparing the Alpha values generated by both funds side-by-side, we can peer beyond the fund’s performance and single out the manager’s ability to produce excess returns for a particular risk level.

Of Alpha and Actively Managed Funds

In the never-ending search for Alpha, is active management still relevant? In short, it’s complicated, but let’s break it down. The proliferation of actively managed funds has been in existence since the advent of the Cold War, where investors stock-pick and select the best equities (blue-chip stocks) in hopes that the appreciation of these assets would grow in tandem with the global recovery. This later proliferated into a booming industry where managers would employ fundamental analysis, together with the birth of modern-day financial theories to explain phenomenons surrounding the capital markets. Fast forward today, active managers face a new challenge arising from the opposite end of the asset management spectrum — passive management.

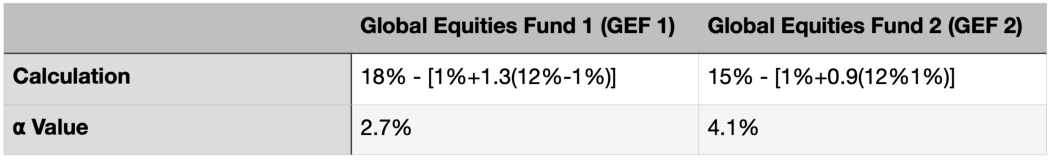

Figure 1: Total net assets (by asset classes) for passive managed fund universe (Source: Morningstar, 2020).

Figure 1: Total net assets (by asset classes) for passive managed fund universe (Source: Morningstar, 2020).

The performance for active and passive management is nearly indistinguishable for the past two decades as suggested by recent literature. Where passively managed funds tend to perform during periods of economic boom, active funds tend to thrive better during times of market volatility. Whilst there is empirical evidence that suggests that investors rarely benefit from timing the market, well-equipped active managers have also exhibited some degree of skill in bearish conditions. Despite such, the recent decade has proven to be difficult for active managers due to the rise of passive strategies. Passive mutual funds have garnered the ability to attract more than US$12 trillion in 2020, sapping out more than US$1.5 trillion from the active managers.

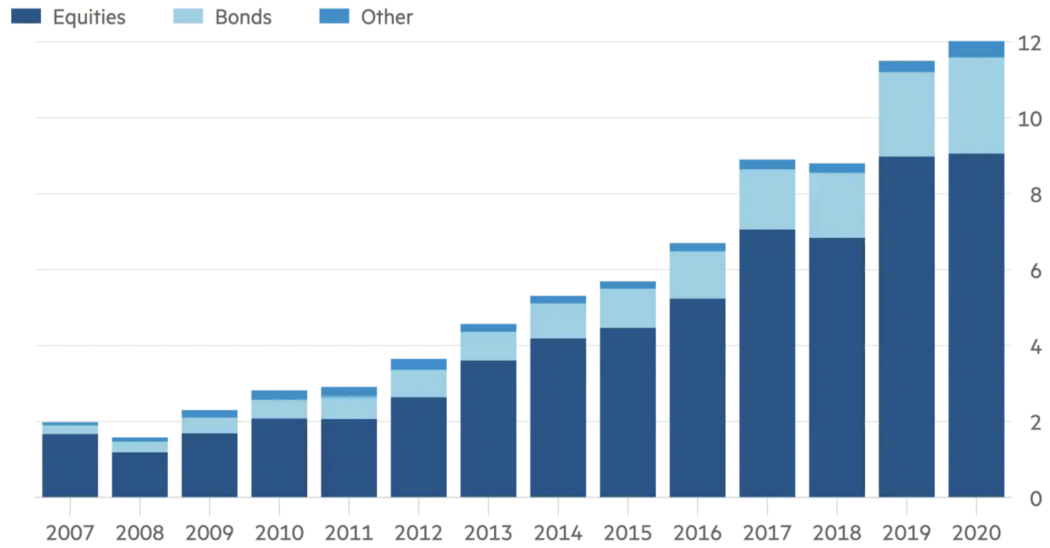

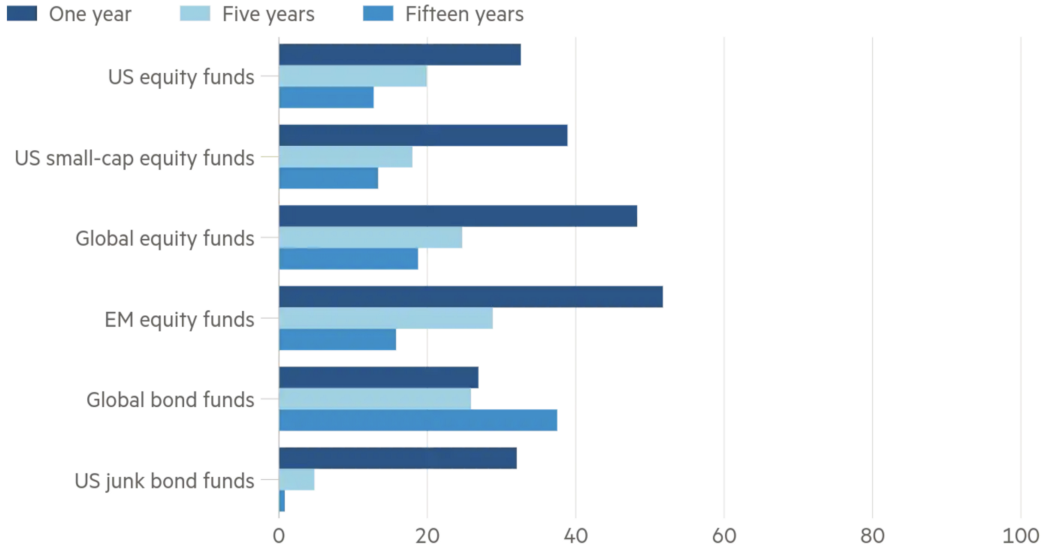

Figure 2: Percentage of funds which outperformed their benchmarks (Source: S&P Dow Jones Indices, 2020).

Figure 2: Percentage of funds which outperformed their benchmarks (Source: S&P Dow Jones Indices, 2020).

Active managers in the past decade have also struggled to beat their benchmarks. This waning confidence is reflected by the shift by institutional investors to swing towards passive strategies for a more cost-efficient means to generating consistent returns. Recent geopolitical upheavals together with the Global Pandemic, however, are expected to rejuvenate the active management globally to reinstate the value of generating returns via a manager. The resilience shown by active managers, considering the Pandemic, is a testament to actively managed funds to be able to survive industry tailspins. This has been true particularly for international equities and developing market funds.

Figure 3: Percentage of fees charged by asset managers by category from 1990–2020 (Source: Morningstar, 2020).

Figure 3: Percentage of fees charged by asset managers by category from 1990–2020 (Source: Morningstar, 2020).

Generating excess returns are not the only hurdle faced by active managers. Increasing fee pressures are plaguing managers globally, with active managers remaining the be the top pick to invite institutional investor scrutiny when it comes to fee-performance considerations. Large active managers have suffered consistent outflows in recent years (see Fidelity) despite managers beating the benchmark by an average of 3% a year for over three decades.

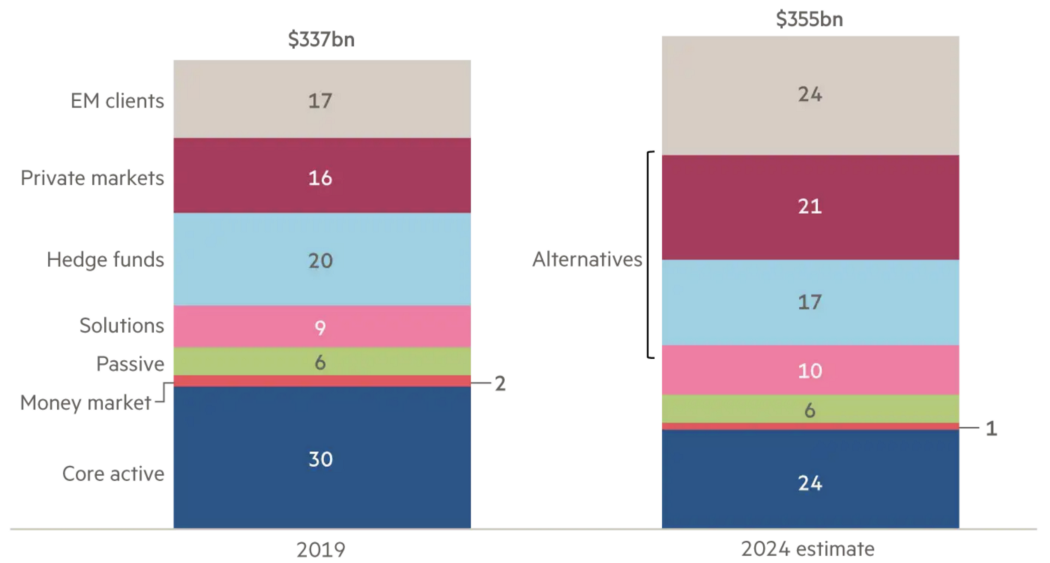

Figure 4: Market shares of investment categories (Source: Oliver Wyman, 2019).

Figure 4: Market shares of investment categories (Source: Oliver Wyman, 2019).

An industry-wide consolidation is inevitable for active management in the coming decades. Analysts opine that how active investors fare in the post-pandemic era would dictate the fate of the managers and advise cautious optimism moving forward for the industry. The discussion of scale and efficiency by active managers have been largely influenced by the shift in capital allocation to alternative strategies in active management, with an estimated 38% being allocated to hedge fund strategies and the private markets by 2024. This shift may also reflect the lofty expectations by investors unto managers in generating new, and perhaps, vastly superior performance via new techniques and methodologies.

The future of active management is uncertain based on how the cards are currently been dealt. One silver lining is the emergence of Smart Beta, which is an amalgamation of both active and passive management styles. Smart Beta strategies aim to deliver market-beating performance in a cost-efficient and transparent manner. The simplicity of Smart Beta portfolios is comparable to that employed by passive strategies but augmented to that of active management by selecting assets that exhibit return-generating drivers such as size, momentum, and value, all of which are proven to have performed well historically.

Finding Alpha Through Quantitative Investing

The recent rise in quantitative investing (or Quant Investing) has largely been fueled by the mass adoption of technology and big data. Fund managers employing quantitative finance into their investment methodologies use mathematical algorithms to perform systematic, evidence-based assessments of an asset’s fundamentals and valuation, typically on a pool of investable assets.

Utilising repeatable processes, quantitative investing also avoids common investing pitfalls that investors typically would face by removing any emotional inputs. Quant investing also allows investors to exploit repeatable patterns exhibited by other investors in the market by looking through the lens of behavioural finance and economics. Whilst detractors may argue that managers that employ quantitative methods in investment decisions tend to have issues with model ‘overfitting’ (i.e., heavy reliance on past data to develop predictive models). However, quantitative methods typically involve a process of research, analysis and refinement of the investment model which remedy the issue.

The empirical and systematic nature of quantitative investments makes the use of automated processes and cutting-edge technology a perfect match. Automation together with the use of scalable technology would allow managers to shrink down operating costs, where traditionally analysis has required a team of researchers and analysts to scrutinise individual securities prior to investing. Furthermore, the application of efficient computing power allows managers to comb through billions of datapoints which includes financial and alternative data in a short period.

Applying rigorous and well-tested financial theories applied in modern finance (i.e., Black-Scholes model, modern portfolio theory, efficient market hypothesis, behavioural finance etc) allows managers to single out core return drivers or potential pockets of alpha. Since fundamental strategies focus on firm-level characteristics and quantitative strategies generate an excess return from alpha factors, it could be said that both are complementary. Combining both fundamental and quantitative approaches further compound the ability of managers to draw returns from a relatively smaller pool of assets that share a common characteristic or factor (see factor investing), together with exploiting any behavioural biases exhibited by investors in the market.

The future of quantitative finance continues to blur the separation between the two approaches of investing. As more alternative (non-financial) data is being incorporated into strategies, investors can expect unique, yet empirically proven strategies to be developed by asset managers that have access to the computing power and human capital search for new pockets of alpha. For the average investor down the street, the decision to select winning strategies and funds becomes a more dizzying affair. Just like an asset manager, navigating through the noise requires investors to be equipped with the latest tools and technology to sieve through investment methodologies that balance risk and reward.

Existing tools which enable investors to take back the reins in asset management remain limited today. Managers, new and old, leverage on this by creating products that are a byproduct of the tools used by managers (i.e., funds, ETFs etc.). However, at AxeHedge, we take a different approach to aid investors to find their Alpha. We begin by giving access to industry-grade investment tools and resources to help users make their own investment decisions easily and in an efficient manner. The tools that we build are designed to be simple, easy-to-understood and calibrated, and allow investors to manage their capital at their own terms and pace. At AxeHedge, we believe that the future of investing is democratised and digital, and that’s why we have dedicated our resources to bringing hedge fund-style investing and quantitative approaches directly to our investors.

We hoped you’ve enjoyed this piece and appreciate the time you spent reading. We love making and sharing content which are insightful and actionable. If you would like us to break down complex topics in investing and finance (or anything that you are curious about), drop us an email at: hello@axehedge.com. Our team will be in touch with you.

Stay tuned for more exciting content, coverage and latest news about the world of finance. Visit AxeHedge.com to learn more about what we do and how can we help you in your investment journey.